estate tax changes effective date

Among tax changes in bills that have been recently introduced. List of the estate and gift tax proposals gives the date each proposal was eventually enacted in some form.

Estate Tax Law Changes What To Do Now

The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted effective January 1.

. Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022. However the change to the top capital gains rate which is increased to 25 is effective. The House Ways and Means Committee proposes to replace the flat 21 percent corporate income tax rate with graduated rates of 18 percent on the first 400000 of income.

Then you likely annihilated your previous revenue. Up to 25 cash back Federal Estate Tax Exemption -- 114 million. If the trust later sells the property for 110000 the trust can offset the gain with the 30000 previously disallowed loss and only pay tax on a 10000 gain as though its basis.

On April 21 Ohio Gov. Unless your taxable estate is worth more than 114 million your estate will not owe federal estate tax if. Increasing Tax Rates for Trusts and Estates.

If a wealth tax would be enacted it could be applied to assets in trust or possibly just assets in trust after the effective date. Retroactive Tax Law Change. Estate and Gift Tax Exemption Reduction Using the Excess Exemption Before Its Lost.

Federal estate tax exemption reduced to 35 million. Increased Income Tax Rates for Estates and. Addressed in the plan are numerous tax law changes but this alert will specifically address the provisions that directly impact estate tax planning Effective date.

Oshins Esq AEP Distinguished If you are an estate planner you likely had your best revenue ever in 2012. Imposition of capital gains tax on appreciated assets transferred during life or at death. The effective date of these tax rates and the tax bracket is January 1 2022.

By Steven J. The proposed effective date for the estate and gift tax changes would be for death and transfer after December 31 2021. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

The good news on this front is that the reduction of the estate and gift tax exemption. While any proposed changes to tax and estate law probably wont pass. January 1 2022 EstateGift.

Reduction in Federal Estate and Gift Tax Exemption Amounts. As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

The good news on this arena is that the reduction of the estate and gift tax exemption from 10000000 as adjusted for inflation presently 11700000 per person will. 126 was introduced in early 2021 and purports to substantially modify the process for. Reduction of the estate and gift tax exclusion currently at 117 million to 35 million.

Taxation of appreciation at death or at the time of gifts carryover basis enacted. That is only four years away and. The unified estate and gift tax exemption is currently 117 million and is already.

Effective January 1 2022 as introduced. 126 with an effective date of July 21. For the 995 Act.

Mike DeWine signed HB. The Green Book proposals effective dates Treasury revenue estimates and implementation of these policies change during the regulatory and legislative processes. The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million adjusted for.

The effective date of these tax rates and the tax bracket is January 1 2022. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500. The following summarizes some of the proposed estate and gift tax changes.

The change would be effective as of the date of enactment.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

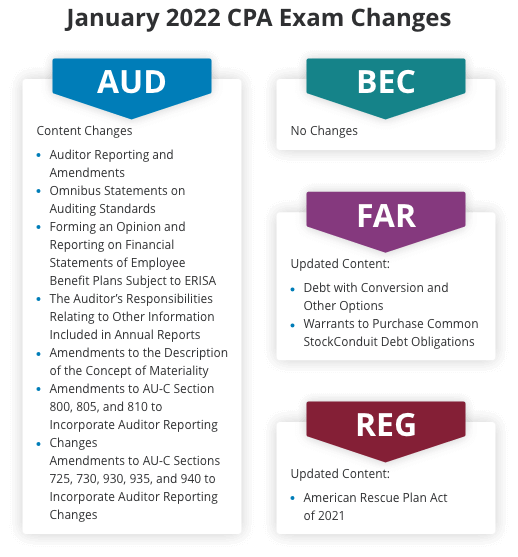

Cpa Exam Changes Updates On The Cpa Regulations

Estate Planning 2022 Federal Tax Update Lathrop Gpm Jdsupra

See Seven Major Factors That Effect Real Estate Appreciation Https Www Livegulfshores Real Estate Infographic Getting Into Real Estate Real Estate Marketing

Here Are New Tax Law Changes For The 2022 Tax Season Forbes Advisor

How The Tcja Tax Law Affects Your Personal Finances

What Should Be On The Top Of Your Priority List When Renovating Your House See Which Remodeling Projects Home Improvement Projects Home Buying Home Projects

Room Rental Agreement Template Real Estate Forms Rental Agreement Templates Room Rental Agreement Real Estate Forms

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

It May Be Time To Start Worrying About The Estate Tax The New York Times

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Closing Disclosure Calendar 2020 Image Calendar Examples How To Find Out Calendar

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Philadelphia Estate And Tax Attorney Blog Irs Payment Plan Business Plan Template Free Irs